Broad-Based ETFs Unleashing Opportunities to Invest in China A-Shares Amid Market Recovery

Guangzhou, China (ANTARA/PRNewswire)- According to a recent report about market data released by the Shenzhen Stock Exchange, there are a total of 379 ETF products with a combined market cap of US$83.8 billion and the trading volume for ETFs in April amounted to US$63.6 billion, as of the end of April 2024. The top three most-traded ETFs (excl. money market funds) listed on the Shenzhen Stock Exchange were E Fund ChiNext ETF (Code: 159915), HuaAn ChinaBond 1-5 Year CDB Bond Index ETF, and Harvest CSI 300 Index ETF, with trading volumes of US$3,548 million, US$2,949 million, and US$2,787 million, respectively.

The significant net inflows into China A-shares market, particularly in equity ETFs, reflect growing investor confidence in the potential of onshore stock market and prospects of economic growth. As of May 28, equity ETFs across the China A-shares market, including Shanghai Stock Exchange and Shenzhen Stock Exchange, have seen a net inflow of US$45.3 billion, while broad-based ETFs of over US$47.8 billion. Among them, CSI 300 index, CSI A50 index, ChiNext index, and SSE STAR Market 50 index are gaining traction.

Particularly, E Fund Management ("E Fund"), as the largest fund manager in China, has attracted a cumulative net inflow of US$13.6 billion into its broad-based ETF offerings this year. Meanwhile, E Fund has been actively positioning new broad-based products and launched E Fund CSI A50 ETF two months after the release of the index in January, which differentiated as more balanced in industry allocation and incorporated ESG exclusionary strategy.

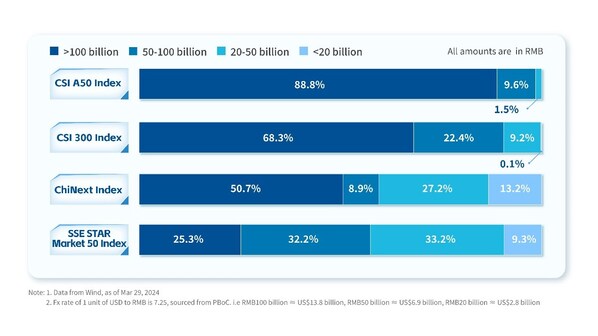

Although both CSI 300 index and CSI A50 index are representatives of large-cap stocks, with an average market cap of US$18.5 billion and US$35 billion, CSI A50 index unleashed opportunities to invest in mega-caps that 89% of its constituents have a market cap over RMB100 billion (US$13.8 billion).

Some other broad-based indices, such as ChiNext index and SSE STAR Market 50 index, are composed of mid-to-large cap companies featuring high growth potential. The ChiNext index is composed of 100 stocks listed on the ChiNext board with an average market cap of US$6.5 billion, most of which prioritized sectors such as new energy and healthcare. Whereas SSE STAR Market 50 Index is composed of 50 large and liquid stocks from the STAR Market, with an average market cap of US$6 billion, and leaned more towards semiconductor sector.

(share of indices by market cap)

About E Fund

Established in 2001, E Fund Management Co., Ltd. ("E Fund") is a leading comprehensive fund manager in China with close to RMB 3.2 trillion (USD 450 billion) under management.* E Fund's clients include both individuals and institutions, ranging from central banks, sovereign wealth funds, social security funds, pension funds, insurance and reinsurance companies, to corporates and banks. Long-term oriented, it has been focusing on the investment management business since inception and believes in the power of in-depth research and time in investing.

* AuM includes subsidiaries. FX rate is sourced from PBoC.

Source: E Fund Management